Financial Literacy is a Workplace Essential

Hidden Cause of Employee Burnout

If you manage employees at a small or mid-sized business in Northeast Ohio, you know how challenging it is to attract and retain good people.

You also know how quickly productivity can slip when your team is stressed or distracted.

But what if one of the biggest contributors to employee disengagement isn’t your culture, your comp plan, or even your workload?

What if it’s your employees’ finances?

Study after study points to one powerful—and too often overlooked—factor in workplace satisfaction: employee financial literacy.

It’s not just a nice-to-have perk. It’s a must-have strategy.

And the research is clear: financial literacy directly impacts workplace performance, employee retention, and job satisfaction.

Here’s what the data says, and what you can do about it.

Financial Stress Is Hurting Your Bottom Line

Employees aren’t just stressed physically or mentally—they’re financially stressed. According to the PwC’s most recent Employee Financial Wellness Survey:

60% of employees report feeling stressed about their finances.

44% say financial worries distract them while at work.

56% spend three or more hours per week dealing with financial issues on the clock.

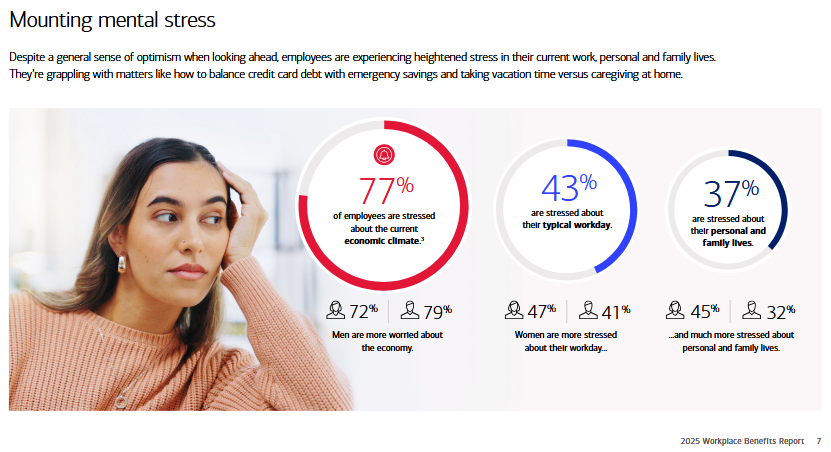

And it doesn’t stop there. According to the MetLife 2025 Employee Benefit Trends Study, one in three say economic stress has impacted their ability to focus and be productive.

Lastly, employers reported to the International Foundation of Employee Benefit Plans that their employees’ financial challenges cause:

“Presenteeism”/inability to focus (42%)

Lower morale (35%)

Absenteeism/tardiness (29%)

These aren’t isolated problems. They’re organizational vulnerabilities every business is facing in 2025.

Financial Wellness = Higher Retention and Morale

The good news? Financial confidence makes a measurable difference. Employees who feel financially well are:

Twice as likely to be satisfied with their jobs (Bank of America 2025 Workplace Benefits Report).

75% more likely to stay with their employer (SoFi at Work Survey 2024).

And for businesses offering financial wellness programs, the benefits are clear.

Employees who trust their employer and feel cared for (driven by clear, supportive benefits experiences) are twice as more engaged and productive than peers without that support.

And 8 in 10 employers report that providing financial wellness resources helps drive job satisfaction and productivity, as well as talent attraction.

Your Team Wants Financial Education (Even If They Won’t Ask)

Employees want more than a paycheck—they want peace of mind. In fact, 80% say they expect their employer to offer financial wellness tools (PwC). Yet many companies still see it as “extra.”

Meanwhile, financial knowledge gaps are widespread:

Only 46% of U.S. adults can answer 4 out of 7 basic financial literacy questions correctly (FINRA 2025 National Financial Capability Study).

Fewer than 1 in 5 Gen Z workers feel confident making everyday financial decisions (TIAA Institute, 2023).

These gaps affect real lives—and real productivity. These aren’t just “young people problems.” They are workforce-wide gaps that affect morale, trust, and performance.

Financial literacy is moving from “nice-to-have” to strategy.

2025 data from SHRM highlights that employers should pair financial education with clear benefits communication (e.g., how pay works, how to use HSAs/401(k)s, debt and budgeting basics) because financial literacy improves workplace outcomes.

A Simple Solution That Starts with You

You don’t need a massive HR or training budget to make an impact. You just need a plan and a partner.

Achieve Credit Union can bring you financial wellness resources at no cost to your small or mid-sized business, including:

Financial Wellness Survey to assess your team's needs

Engaging on-site workshops or Lunch & Learns covering essential financial literacy topics

One-on-one financial coaching

Financial apps and money management resources

When your employees feel more confident about their finances, they show up stronger, stay longer, and contribute more.

Ready to Talk?

If you’re ready to reduce stress, boost productivity, and build a culture of trust in your business, we’re here to help.

Let’s bring financial literacy into your workplace and turn this perk into one of your most valuable benefits!

Take The Next Step.

Visit A BranchStop by your local branch, and we’ll be happy to help you!SEE LOCATIONS |

Talk With UsCall (440) 324-3400 to speak with our Member Services team.CALL US |

Become a MemberIt’s easy to join Achieve CU and open your account.JOIN US |

About the Author

Shannon Browne

Shannon Browne is the Vice President of Human Resources at Achieve Credit Union. With over 20 years of HR leadership experience, Shannon understands the day-to-day challenges businesses of every size face.

Fun Fact: Shannon believes jeans days are the best day of the work week!